When it comes to putting your money into gold, you have two primary choices: a Gold IRA or physical gold. Each presents its own unique advantages and disadvantages. A Gold IRA is a specialized type of Individual Retirement Account that allows you to contribute precious metals like gold, silver, platinum, or palladium within the account. Physical gold, on the other hand, refers to owning actual bullion.

The best choice for you will hinge on your specific circumstances. A Gold IRA may be a better alternative if you're looking for tax-deferred growth and the ability to diversifyyour holdings. Physical gold, however, can provide a sense of security.

- Think carefully about your investment goals, risk tolerance, andcurrent assets

- Explore both options thoroughly

Planning Your Retirement? Gold IRA vs. 401(k) Compares

When planning for your golden years, two popular paths stand out: the Gold IRA and the traditional 401(k). Each provides unique strengths, making the decision a tricky one. A Gold IRA allows you to put your savings into physical gold, potentially protecting against market fluctuations. A 401(k), on the other hand, is a income-sheltered program that presents options in a range of assets, including mutual funds.

- Consider your comfort level with risk

- Explore the charges associated with each strategy

- Speak with a qualified consultant to acquire personalized guidance

Is a Gold IRA Worth It?

Thinking of investing in a Gold IRA?? The idea of shielding your savings from market volatility with physical gold sounds appealing, but is it all hype? A Gold IRA offers potential benefits like diversification and inflation hedge, but there are also drawbacks.

- Significant upfront fees

- Annual maintenance fees

- Limited liquidity

Before diving headfirst, weigh these pros and cons. Consult with a qualified professional to determine if a Gold IRA is the right choice for your individual needs.

Best Gold IRAs for Secure Retirement Savings

Planning for retirement can seem overwhelming, but a gold IRA may offer a valuable way to secure your well-being. These special accounts allow you to allocate in physical gold, providing a potential hedge against inflation.

Here's a look at some of the top-rated gold IRAs on the platform to guide you in finding the right fit:

* Company A: Known for their competitive fees and excellent customer support.

* Vendor E: Focuses in gold holdings and offers a diverse selection of gold options.

* Organization H: Highly respected for their experience in the gold IRA sector.

Before selecting a decision, it's crucial to explore different providers and compare their offerings. Consider factors like fees, minimum investments, storage options, and customer support.

Unlocking Tax Advantages with a Gold IRA: A Comprehensive Guide

Thinking about augmenting your retirement portfolio? A gold IRA could be the answer. These IRAs offer a unique opportunity to shelter your savings from market volatility while potentially reaping significant tax perks. By holding physical gold within an IRA, you can exploit several tax benefits not available with traditional investment accounts. This comprehensive guide will shed light the intricacies of a Gold IRA, empowering you to make informed decisions about your financial future.

- Discover the tax advantages of gold IRAs

- Understand the different types of gold investments for IRAs

- Acquire how to set up a Gold IRA

- Explore factors to consider when choosing a reputable custodian

- Gain valuable insights into managing your Gold IRA for long-term success

Selecting the Best Gold IRA Provider in 2023

Embarking on your quest to invest in a Gold IRA can feel overwhelming. With numerous companies vying for your business, it's crucial to carefully evaluate your options and choose a reputable partner.

To ensure you make an informed choice, begin by identifying your individual needs. Determine the value you're comfortable contributing and research different providers that align with your investment strategy.

- Seek a provider with a proven track record and positive client feedback.

- Grasp the fees associated with opening and maintaining a Gold IRA, as these can materially impact your returns.

- Confirm that the provider is properly authorized by relevant financial authorities.

By adhering to these guidelines, you can successfully choose a Gold IRA provider that will more info help you attain your financial goals.

Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Erika Eleniak Then & Now!

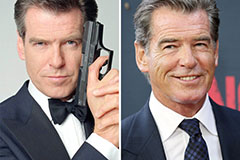

Erika Eleniak Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!